Past Movement: Healthcare Sector in 2024

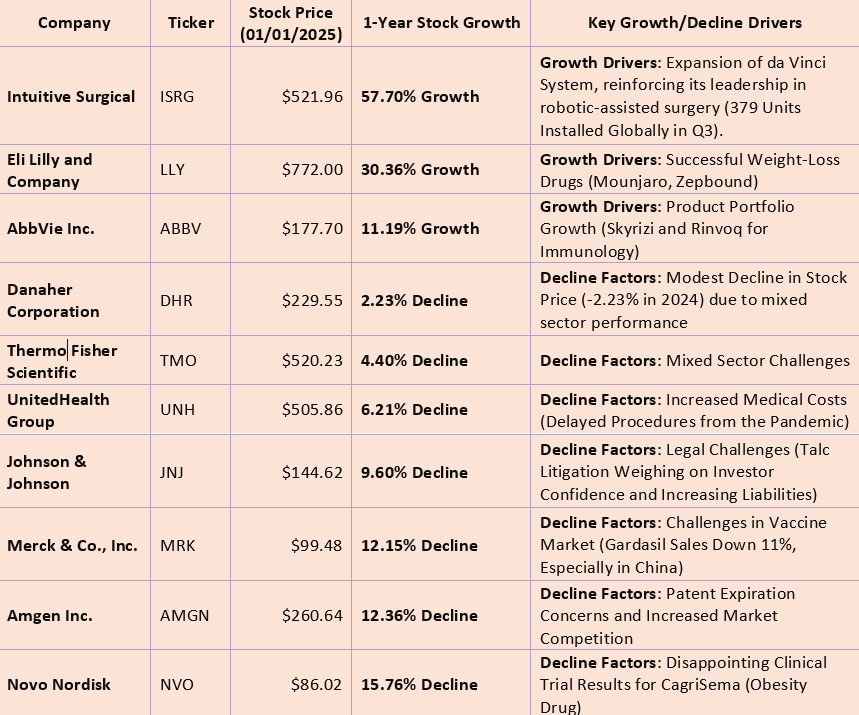

The healthcare sector in 2024 reflected a complex interplay of innovation, market competition, legal challenges, and economic pressures. While some companies emerged as leaders, capitalizing on groundbreaking products and strategic decisions, others faced setbacks, including regulatory hurdles and sector-wide challenges.

Overall, Healthcare stocks have lagged behind the S&P 500 as investors favored high-growth tech stocks over more defensive sectors (Fidelity).

Looking Ahead: Healthcare Sector in 2025

As we transition from 2024 to 2025, the healthcare industry is poised for significant transformation, driven by technological innovation, evolving care models, and strategic adaptations. The past year has highlighted a complex interplay of advancements, market competition, legal challenges, and economic pressures, setting the stage for the developments anticipated in 2025.

1. A Year of Optimism and Resilience

Healthcare executives are entering 2025 with renewed optimism. According to a Deloitte survey, 60% of industry leaders hold a favorable outlook, up from 52% the previous year. Moreover, 69% of respondents anticipate revenue growth, while 71% expect improved profitability. This positive sentiment reflects a shift from stabilization to strategic expansion after years of pandemic-induced disruptions (Deloitte).

Innovation and resilience remain central themes as organizations navigate challenges such as labor shortages, rising costs, and regulatory uncertainties. With Medicare Advantage enrollment projected to grow to 35.7 million, and an expected 90 million lives under value-based care (VBC) models by 2027, the healthcare sector is undergoing a paradigm shift toward efficiency and patient-centric approaches (Athenahealth).

Key Trends Shaping 2025

- Integration of Artificial Intelligence (AI)

AI investment in healthcare is projected to grow from $20 billion in 2024 to $150 billion by 2029, with organizations leveraging AI to combat clinician burnout, streamline administrative processes, and enhance diagnostic accuracy (Athenahealth).

- Use Cases: AI-powered transcription tools, predictive analytics, and personalized care plans are already transforming care delivery. Machine learning (ML) applications are being used to identify patterns in imaging scans and develop tailored treatment plans (Athenahealth).

- Challenges: Data privacy and compliance with HIPAA remain barriers. Organizations are investing in secure, private AI systems to address these concerns.

- Future Potential: AI could revolutionize patient-provider communication, supporting clinical decision-making and reducing operational inefficiencies.

Heather Lane, Senior Architect of Data Science at athenahealth, predicts that practical applications like automatic note generation will gain prominence, easing the day-to-day workload for providers while mitigating risks (Athenahealth).

2. Growth in Key Specialties Urgent Care: With over 14,000 urgent care centers and a 7% annual growth rate, this segment is addressing gaps in immediate care, reducing reliance on ER visits, and offering accessible solutions for non-emergency conditions (Athenahealth). Behavioral Health: The rising demand for mental health services is fueled by reduced stigma and increased political focus. By 2027, 25% of the U.S. population is expected to use behavioral health services, with telehealth playing a critical role in expanding access (Athenahealth).

3. Adoption of Value-Based Care (VBC) Models

The shift toward value-based care is accelerating, with organizations prioritizing outcomes over volume. Research shows that 47% of providers using mixed payment models report financial stability (Athenahealth).

- Interoperability: Seamless integration between EMRs and healthcare IT systems is critical for managing patient data and creating holistic care plans.

- Risk and Rewards: Accurate risk coding, adherence to high-quality provider referrals, and expanded remote patient monitoring will be key focus areas.

McKinsey & Co. estimates that the adoption of VBC models will increase by 109% from 2022 to 2027, reshaping reimbursement strategies across the sector (McKinsey & Company).

4. Surge of Digital Tools

Digital engagement tools such as patient portals are gaining traction, with 75% of patients citing these tools as improving their healthcare experiences (Athenahealth).

- Telehealth and Beyond: While telehealth utilization remains high in specialties like women’s health and behavioral health, organizations are also focusing on robust digital solutions for scheduling, communication, and self-service options.

- Financial Incentives: Providers with high digital engagement report faster revenue cycles and improved patient payment yields, highlighting the financial and operational benefits of these tools.

5. Workforce Challenges and Technological Solutions

The ongoing shortage of healthcare workers—projected to reach 200,000-450,000 registered nurses in 2025—is pushing organizations to adopt innovative solutions. Generative AI and automation technologies are being deployed to reduce administrative burdens and allow clinicians to focus on patient care (McKinsey & Company).

Health systems are also investing in workforce wellness programs and advanced staffing models, including virtual nursing and upskilling initiatives, to mitigate burnout and enhance retention.

6. Regulatory Outlook Under New Leadership

The incoming administration, led by Donald J. Trump, is expected to bring changes to Medicare Advantage, price transparency, and drug-pricing regulations. 44% of healthcare executives cite regulatory uncertainty as a key factor influencing their strategies for 2025 (Deloitte).

- Potential Reforms: Adjustments to Medicare Advantage payment rates and bipartisan-supported initiatives like site-neutral payment policies could reshape the sector.

- Compliance Strategies: Organizations are prioritizing agile and proactive approaches to navigate the evolving regulatory landscape.