The US stock market has been doing well and has grown over the last couple of years, and the indications are that this momentum will continue in 2025 as well. To be specific, the technology sector, on the back of performance and strategic policy support, continues to be a key catalyst for market earnings.

The Federal Reserve’s Steady Hand

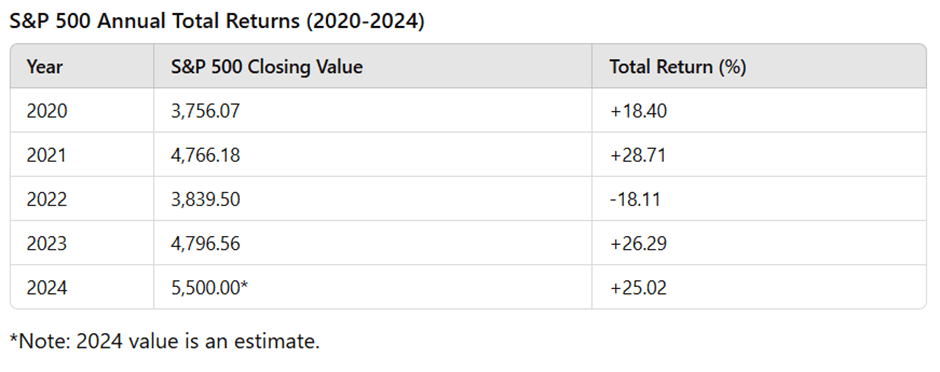

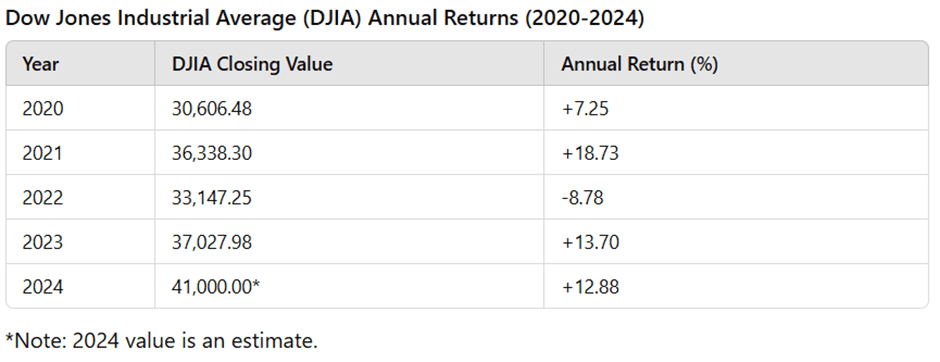

Monetary policy will be the guiding hand to how the stock market will perform. The Fed has tried, over the past two years, to walk a tightrope between taming inflation and supporting economic stability. Interest rates have increased gradually to 5.25% mid-2023 in response to inflationary pressures. In 2025, provided that excessive tariffs are not imposed by the Trump administration and inflation remains under control, the Fed may make minor cuts/adjustments to support the economic momentum without recession. Such stability in interest rates would most likely keep markets confident and the market would continue to grow similar to past couple of years as observed in the tables of below, especially in areas of interest rate-sensitive sectors like technology and real estate (DJIA | FRED).

Fiscal Stimulus: A Catalyst for Growth

Government-driven fiscal programs may be the very important stimuli for growth in 2025 through infrastructure investments or green energy. Traditionally, such initiatives, witnessed with the CARES Act and succession of policies afterwards, tend to pump liquidity into the economy, resulting in higher consumer spending and corporate earnings (U.S. Department of the Treasury).

Moreover, future investments in infrastructure modernization and clean energy are coupled with programs like the IRA and, therefore, are likely to boost sectors like advanced manufacturing and renewables, further improving market performance, especially for those stocks that are closely related to such growth areas (Congress.gov).

Technology Sector Dominance

The technology sector remains the backbone of the U.S. economy, with leading companies in their respective areas performing very well (Morningstar). Giants like Apple, Alphabet, and Microsoft announced record earnings driven by innovation and operational efficiency in 2024. Prior to that the S&P 500 ended 2023 with a 24% increase and has moved modestly higher at the start of 2024 (Yahoo Finance | S&P 500). NVIDIA, the leader in AI and GPU technologies, announced an unprecedented $50 billion stock buyback program, showing its confidence in long-term growth (Yahoo Finance | NVIDIA $50 Billion Stock Buyback).

Added policy-driven inducements include things like the CHIPS and Science Act-which provided for a $52-billion outlay of semiconductor manufacturing-appropriation for 2025 is expected (White House Fact Sheet on CHIPS Act). Governments may grant traction to fledgling technologies surrounding artificial intelligence, quantum computing, and alternative forms of energy as 2024 leads into next year, shoring up valuations even further among concerned stocks.

Global Trade and Economic Partnerships

International trade dynamics and economic partnerships could also play a critical role in stock market growth (U.S.-Japan Trade Agreement Overview). Trade deals and cooperative agreements with emerging markets, Japan or Europe could stabilize trade flows, benefiting MNCs reliant on global markets. Companies like Apple and Boeing, which have historically gained from trade breakthroughs, may see continued growth if similar agreements materialize in 2025.

Infrastructure and Environmental Investments

Infrastructure spending, due to legislation like the Bipartisan Infrastructure Law, has powered growth in building, materials, and technology companies. Companies including Caterpillar, Cisco Systems, and Vulcan Materials are direct beneficiaries. Further investment in modernizing the nation’s roads, broadband, and clean water systems would likely lead to more growth in such sectors (The White House Infrastructure Overview).

Similarly, environmental regulations and subsidies for renewable technologies change industrial landscapes. Renewable energy firms, such as Tesla and NextEra Energy, would also benefit from increasingly rigid emissions standards, along with new markets for sustainable technologies. Such trends do seem to be very consistent with the rising interest on the part of investors in equities with a focus on sustainability (U.S. Department of Transportation).

Exceptional Financial Health of Leading Companies

The U.S. companies have remained really resilient, reporting very strong profitability, where many leaders implement strong stock buyback programs: Apple, Alphabet, Meta, NVIDIA-buy back their shares significantly. This is a signal of financial health that adds value for shareholders.

In 2024, Apple reported profits of $96.995 billion, maintaining its status as one of the most profitable companies globally. Alphabet Inc. (Google) reported earnings of $73.795 billion in 2024, driven by its dominance in search and advertising. Microsoft Corporation, with profits of $72.361 billion in 2024, Microsoft continues to benefit from its cloud services and software offerings. Meta reported earnings of $39.098 billion in 2024, indicating robust performance in the social media and advertising space. Amazon Inc. reported earnings of $30.425 billion in 2024, driven by its diversified business model. NVIDIA reported profits of $29.760 billion in 2024, reflecting its leadership in the graphics processing unit (GPU) market and advancements in AI technology (Fortune500 | 50Pros).

Conclusion: A Promising Outlook for U.S. Stocks

The interaction between macroeconomic conditions and sectoral dynamics could, therefore, keep U.S. stocks on the right path this year. It’s the case that stable monetary policy, focused fiscal initiatives, and an ever-formidable tech sector may just ensure continued growth is well-seeded. As new innovative breakthroughs in various segments happen continuously, including investments made towards more sustainable solutions, the U.S. stock market should also build upon the growth realized in the last year, so much so that this important pillar continues to make major contributions toward underpinning the world’s economic stability.

Work Cited

U.S. Department of the Treasury Resources: CARES Act and succession of policies

https://home.treasury.gov/policy-issues/coronavirus

Legislative Information on Congress.gov: Infrastructure Investment and Jobs Act

https://www.congress.gov/bill/117th-congress/house-bill/3684

Why These Seven Stocks Are Earnings-Season Winners | Morningstar

The S&P 500’s Wild Ride to an All-Time High

NVIDIA Approves $50 Billion Stock Buyback: Time to Buy?

https://finance.yahoo.com/news/nvidia-approves-50-billion-stock-184500228.html

White House Fact Sheet on the CHIPS Act

Overview of U.S.-Japan Trade Agreement

https://ustr.gov/countries-regions/japan-korea-apec/japan

White House Overview of Infrastructure Initiatives

https://www.whitehouse.gov/build/

Resources from the U.S. Department of Transportation: Bipartisan Infrastructure Law

https://www.transportation.gov/

Fortune 500 Company Rankings and Earnings | 50Pros.com

https://www.50pros.com/fortune500

Sources for table (Annual Returns for Dow Jones and S&P 500): DJIA FRED, DJIA | WSJ, Slick Charts, Dow Jones Historical Returns by Year Since 1886