As 2025 unfolds, the investment landscape is marked by elevated equity valuations, economic uncertainties, and shifting market dynamics. Amidst these conditions, alternative investments, particularly in healthcare and infrastructure, are emerging as attractive opportunities for achieving absolute returns. This article synthesizes key insights from expert analyses and reports to outline the potential of these alternative avenues, supported by detailed recommendations and examples.

1. The Overvaluation Conundrum in Equity Markets

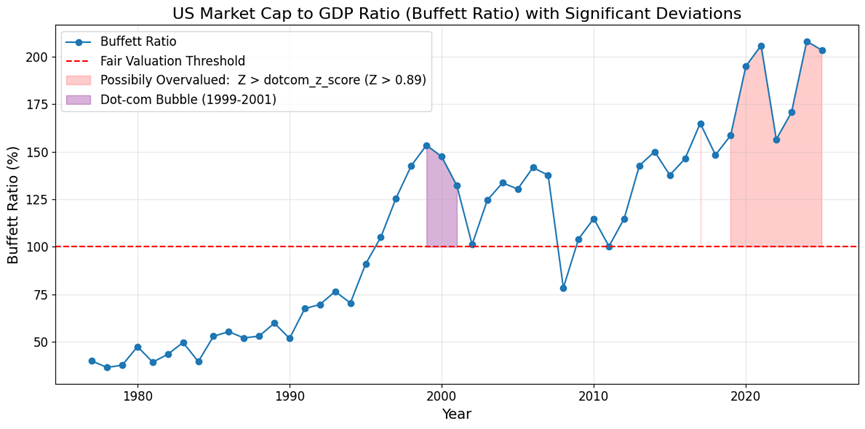

As 2025 unfolds, equity markets are grappling with historic overvaluation and growing economic uncertainties, challenging traditional investment strategies. Metrics such as the Buffett Indicator—tracking the US Market Cap to GDP Ratio—continues to highlight significant market overvaluation. The current ratio levels remain far above the historical fair valuation threshold of 100%, with recent peaks surpassing even the infamous dot-com bubble (Ronsard | Desir Research Group).

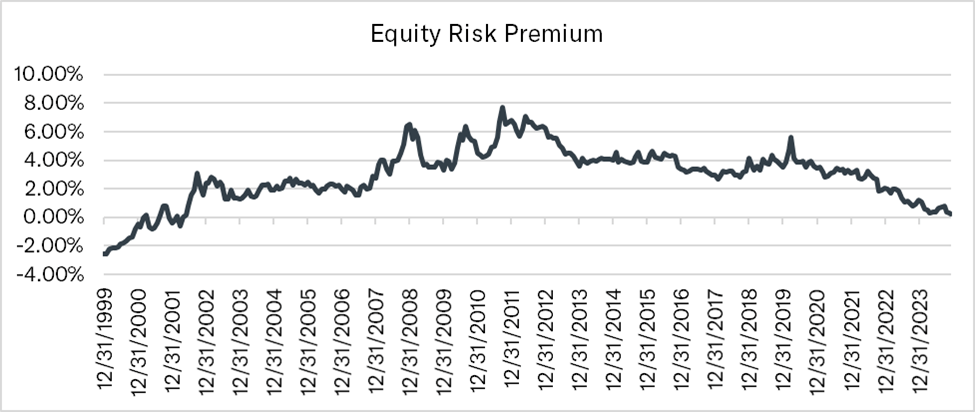

Similarly, the Equity Risk Premium (ERP), a measure of compensation for equity risk over risk-free rates, has fallen to near-zero levels, reflecting a concerning imbalance between risk and return (Seeking Alpha, 2025).

Further amplifying these risks, forward P/E ratios for the MegaCap-8 stocks remain at elevated levels, with these companies trading at a 30.9 multiple, compared to 22.1 for the broader S&P 500 and ~16.5 for smaller-cap categories (Seeking Alpha, 2025).

Amidst these conditions, alternative investments, particularly in healthcare and infrastructure, are emerging as compelling opportunities to achieve resilience and absolute returns. This article synthesizes key insights and provides actionable recommendations to navigate this challenging environment while exploring the potential of alternative avenues.

2. Alternative Investments: A Path to Resilience and Growth

With equity markets nearing a potential correction and offering little reward over risk-free options, alternative investments in private markets stand out as a promising way to achieve steady and reliable returns. Two key sectors—healthcare and infrastructure—stand out due to their robust growth potential and alignment with societal needs.

For further insights into the potential returns for various form of asset classes in 2025, refer to the following strategic analysis and reports on AI-based predictions of returns across asset classes for 2025, including the S&P 500, small-caps, gold, and other key asset classes. These predictions are based on advanced machine learning models, providing a data-driven approach to forecasting asset performance.

Healthcare Private Equity: Riding Tailwinds of Innovation

The healthcare sector in 2025 presents significant opportunities for private equity (PE) investors, driven by demographic shifts, regulatory developments, and technological advancements. These factors are creating scalable and high-growth potential across several areas of the industry.

1. Infusion Services

The infusion services market is expanding due to advancements in specialty drugs and an aging population with chronic conditions. Ambulatory infusion centers (AICs) are emerging as cost-effective and patient-centric alternatives to hospital-based settings. With payors actively promoting this transition to reduce healthcare expenses, private equity investors are increasingly focused on scaling operations through acquisitions and partnerships. AICs align with consumer demand for more accessible and less clinical-feeling care environments (JD Supra, 2025).

2. Post-Acute Care

Post-acute care, encompassing in-home services, hospice care, and behavioral health, remains a key investment area as the industry shifts towards value-based care models. Regulatory updates, including the proposed Hospice Care Act, are poised to reshape this market by introducing stricter compliance measures and expanding benefits like transitional inpatient respite care. These changes, coupled with Medicaid expansions supporting mental health and chronic condition management, provide private equity firms opportunities to modernize and expand services in these sectors (JD Supra, 2025).

3. Physician Practice Management (PPM)

The physician practice management (PPM) sector is witnessing renewed activity following strategic acquisitions by major players. Notably, in January 2025, Mitsubishi Chemical Group selected Bain Capital as the preferred bidder for its pharmaceutical subsidiary, Tanabe Mitsubishi Pharma, in a deal expected to exceed $3.2 billion. This acquisition underscores a focus on consolidating high-growth, high-margin specialties, highlighting the potential for economies of scale and operational efficiency. In 2025, investors are likely to explore untapped provider verticals in specialties like oncology and cardiology, where market fragmentation offers opportunities for consolidation and growth (Reuters, 2025).

4. Artificial Intelligence (AI) Integration

AI is transforming healthcare operations by improving administrative efficiency and enhancing clinical outcomes. AI-driven solutions, such as ambient listening scribes and predictive analytics for infection prevention, are becoming integral to modern healthcare systems. These tools not only reduce operational costs but also enhance patient safety, offering private equity firms attractive avenues for investment in scalable, innovative technologies. However, navigating emerging regulations governing AI use in healthcare remains a critical challenge for investors (Kirkland & Ellis, 2023).

Infrastructure: Meeting the Energy and Housing Challenges

The infrastructure sector is positioned for significant growth in 2025 and beyond, driven by stabilizing interest rates and improving macroeconomic conditions. Rapid digitalization is additionally driving the need for robust infrastructure like data centers and renewable energy.

Key trends shaping this landscape include:

1. Fundraising on a Firmer Footing

As interest rates stabilize, investors are resuming their pursuit of yield, positioning infrastructure as an attractive asset class. The sector offers returns that outpace the risk-free rate while maintaining defensive, inflation-resistant characteristics. This dynamic is expected to bolster fundraising efforts, providing investors with opportunities to achieve favorable entry multiples (J.P. Morgan Private Bank, 2025).

2. Decarbonization and Digitalization Mega-Trends

Two dominant themes are set to drive infrastructure investments:

- Decarbonization: Achieving net-zero emissions by 2050 necessitates substantial investment in green infrastructure. Estimates indicate that approximately $5 trillion annually is required to meet global emissions targets, presenting a significant opportunity for private capital to contribute to sustainable projects (J.P. Morgan Private Bank, 2025).

- Digitalization: The surge in data consumption, particularly fueled by the rapid expansion of artificial intelligence (AI), is propelling demand for data centers. Projections suggest that the AI sector will experience a compound annual growth rate of approximately 42%, reaching a $1.3 trillion market by 2032 (Bloomberg, 2023).

3. Notable Infrastructure Deals

Significant transactions have marked the infrastructure landscape, exemplifying the sector’s dynamism:

- Blackstone’s Acquisition of AirTrunk: In September 2024, Blackstone, in partnership with the Canada Pension Plan Investment Board, acquired AirTrunk, a leading Asia-Pacific data center platform, for an implied enterprise value of over A$24 billion. This transaction stands as one of the largest data center deals globally, highlighting the escalating demand for digital infrastructure (Financial Review, 2024).

- BlackRock and Microsoft’s AI Infrastructure Fund: BlackRock, in partnership with Microsoft, announced plans to launch a $30 billion fund aimed at developing AI infrastructure, including data centers and energy projects. This initiative highlights the substantial investment aimed at supporting AI sector and the needed infrastructures (Tech Startups, 2024).

Navigating Alternative Investment Opportunity in 2025

Navigating the alternative investment landscape in 2025 requires a nuanced understanding of market dynamics and regulatory changes. Key considerations include:

Regulatory Shifts: The current administration’s pro-business policies are anticipated to reduce scrutiny on private equity transactions, especially within the healthcare sector. This shift is expected to facilitate deal-making by alleviating antitrust pressures and implementing favorable policies (Bass, Berry & Sims, 2025).

Interest Rate Normalization: Although interest rates remain higher than historical averages, a gradual decline is creating a conducive environment for private credit and equity deals. The availability of lower-cost leverage enhances the efficiency of transaction structures, enabling investors to pursue opportunities in key sectors such as infrastructure and healthcare (J.P. Morgan Private Bank, 2025).

Sector-Specific Tailwinds: Demographic trends, technological advancements, and societal shifts are bolstering the healthcare and infrastructure sectors. For instance, an aging population is increasing demand for healthcare services, while rapid digitalization is driving the need for robust infrastructure like data centers and renewable energy (Partners Group).

The Outlook for Alternative Investments in 2025

In the face of uncertainty surrounding equity market overvaluation in 2025, the Desir Research Group emphasizes the importance of strategic diversification and a forward-looking approach to alternative investments. Healthcare and infrastructure, driven by demographic shifts, technological advancements, and societal needs, present robust opportunities for steady and long-term returns. Here are our key recommendations:

- Prioritize Resilient Sectors: Healthcare and infrastructure remain well-positioned to withstand market volatility. Investments in healthcare innovations, such as infusion services, AI-driven solutions, and physician practice management, offer growth potential. Similarly, infrastructure investments in renewable energy, data centers, and housing address structural demands.

- Focus on Sustainability and Digitalization: Decarbonization and digital transformation are not just trends but essential growth drivers. Investors should seek opportunities in renewable energy projects, green infrastructure, and hyperscale data centers that support the expanding digital economy and AI technologies.

- Leverage AI and Technological Advances: Supporting ventures that integrate AI into healthcare and infrastructure can enhance operational efficiency and innovation, providing competitive advantages.

- Monitor Interest Rate and Regulatory Developments: As interest rates normalize, the cost of leverage will decline, creating favorable conditions for private equity and credit investments. Regulatory shifts, including eased scrutiny of private equity deals, could further stimulate deal-making in these sectors.

- Adopt a Long-Term Perspective: Infrastructure and healthcare investments often require significant upfront capital but can deliver stable, inflation-resistant returns over time. Aligning investments with enduring societal demands such as housing shortages, energy sustainability, and advanced healthcare will ensure long-term value creation.

The Desir Research Group believes that a proactive, informed, and diversified approach to alternative investments will empower investors to navigate 2025’s economic complexities effectively. By capitalizing on the resilience and transformative potential of healthcare and infrastructure, investors can mitigate risks and unlock meaningful growth in an uncertain financial landscape.

Work Cited

- Chasing Alpha

Equity markets in 2025 are grappling with significant overvaluation, trading at nearly double their historical averages, as detailed by (Seeking Alpha, 2025). - JD Supra

The infusion services market is expanding due to an aging population and advancements in specialty drugs (JD Supra, 2025) - Apollo Global Management S&P 500 and Fed QE highly correlated. Apollo Academy. Retrieved January 21, 2025 (Apollo Academy, 2025)

- Reuters

Mitsubishi Chemical Group’s selection of Bain Capital as the preferred bidder for its pharmaceutical subsidiary highlights the ongoing consolidation in physician practice management (Reuters, 2025). - Kirkland & Ellis

AI-driven solutions are reshaping healthcare by enhancing efficiency and patient safety, as explored in Kirkland & Ellis (Kirkland & Ellis, 2023) - J.P. Morgan Private Bank

Infrastructure offers inflation-resistant returns and strong growth potential in decarbonization and digitalization (J.P. Morgan Private Bank). - Bloomberg Generative AI to be become a 1.3 trillion dollar market by 2032 (Bloomberg, 2023).

- Financial Review

Blackstone’s acquisition of AirTrunk highlights the increasing demand for hyperscale data centers (Financial Review, 2024). - Tech Startup News

BlackRock and Microsoft’s $30 billion fund for AI infrastructure highlights the need for substantial investment in data centers and renewable energy (Tech Startups, 2024). - Bass, Berry & Sims, 2025

The current administration’s pro-business policies are reducing scrutiny on private equity transactions, particularly in healthcare (Bass, Berry & Sims, 2025).