There has been a lot of talk about imposition of tariffs and government spending cuts causing stock market volatility, potential economic slowdown and how that could possibly change Fed’s potential rate cuts into the future. The second major thematic has been what’s the latest in tech. The MAG 7 stocks largely have been on a decline ever since the wave of technological innovation has come out of China. Having said that, there is some interesting statistics and trends in the tech sector which investors can keep an eye on. This report analyzes the developments in the Technology Industry and the future Economic Outlook.

The Evolving Tech Landscape

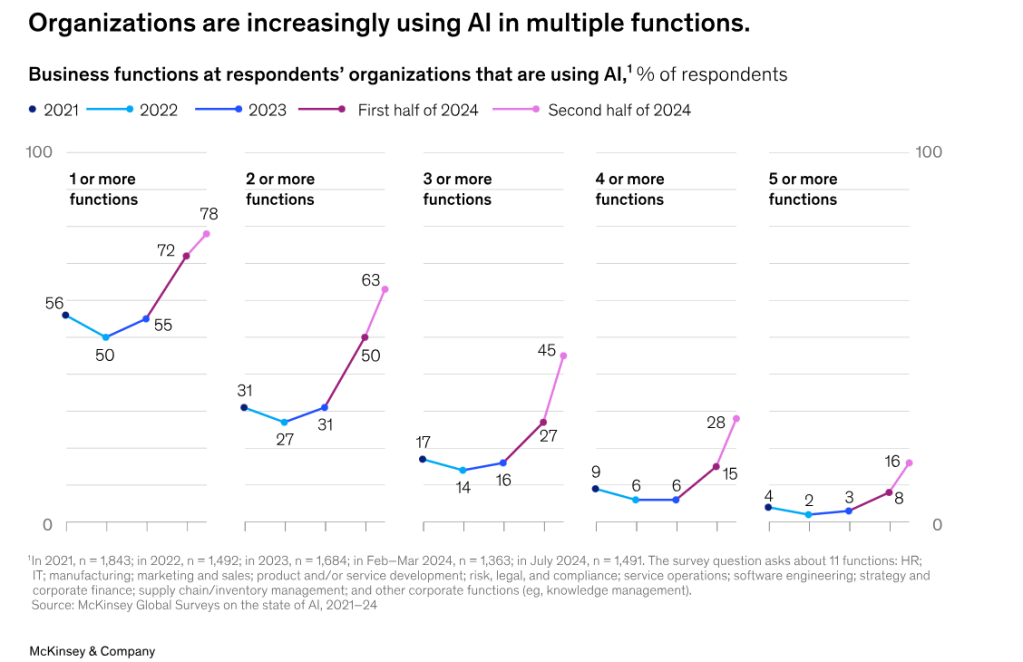

Back in 2023 there was a lot of excitement around AI but there wasn’t a widespread adoption probably because a lot of the AI tools commonly used today were still a work-in-progress. In 2024, we saw a lot more adoption of AI however, largely in easier to implement use cases like chat bots and coding assistants. While this year we have a lot more business specific use cases of AI adoption. eBay for example has come up with AI enabled features called ‘Magical Listing’ and ‘Shop the Look’ on both the supply and demand side respectively.

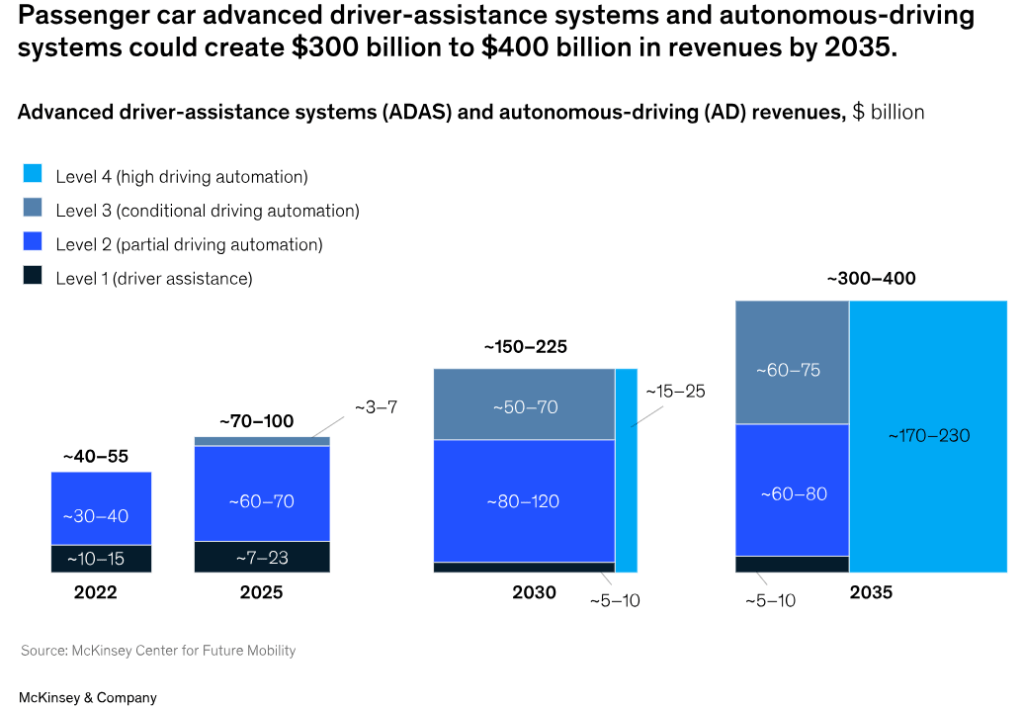

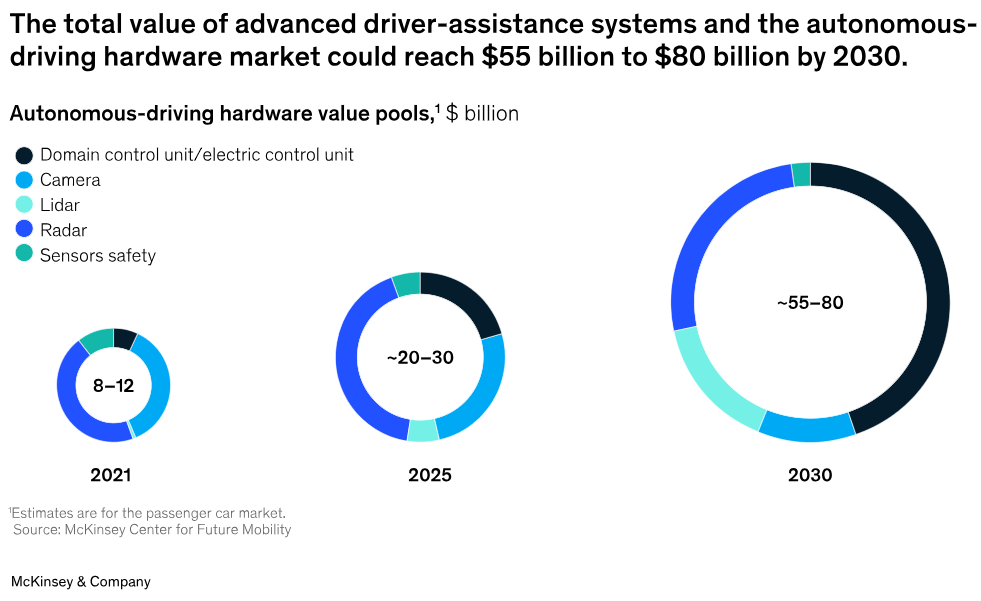

AI agents has gained a lot of attention this year, AI agent is an AI that has complex and more sophisticated reasoning abilities. Talking of AI agents, there has been an increase in the use of autonomous vehicles. Waymo (subsidiary of Alphabet Inc.) for instance, has more than 1000 vehicles in operation. Based on consumer interest in AD features and commercial solutions available on the market today, ADAS and AD could generate between $300 billion and $400 billion in the passenger car market by 2035.

So there’s this competition between key players in tech, between some of the more advanced electric and autonomous car companies such as Tesla. There are also a number of players in China that are propagating these technologies very aggressively. So there is likely a geopolitical angle to this where China seems to have prioritized dominance in these types of technologies.

Not to forget Gen AI, large language models (LLMs) and generative AI has completely changed robotics. It means these cars learn by imitating and watching in a continuous loop using radar, LIDAR, camera or combination of all three, basically these vehicles are now agentic, so the more they drive the better they drive. So you have these geopolitical and technological factors that are going to drive a much more rapid autonomous vehicle adoption than investors think.

Economic Shifts: Tariffs, Fed Policies, and Market Reactions

Speaking of geopolitics, let us take a look at the government policies and how the Fed could react. The government spending cuts to increase efficiency has received a lot of criticism however, it is still uncertain how restricting DOGE from being able to reduce jobs directly without cabinet intervention would stabilize the stock market. The tariff policy is actually the big part of the focus, if the equities keep trading like this we might see some cooldown if not reversal in tariffs.

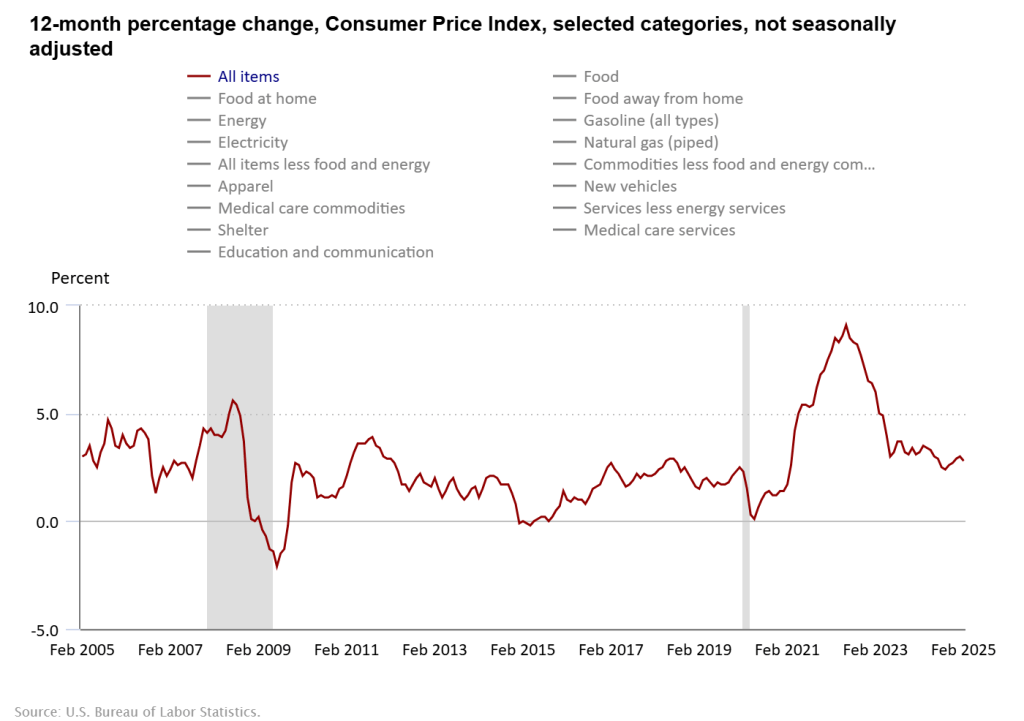

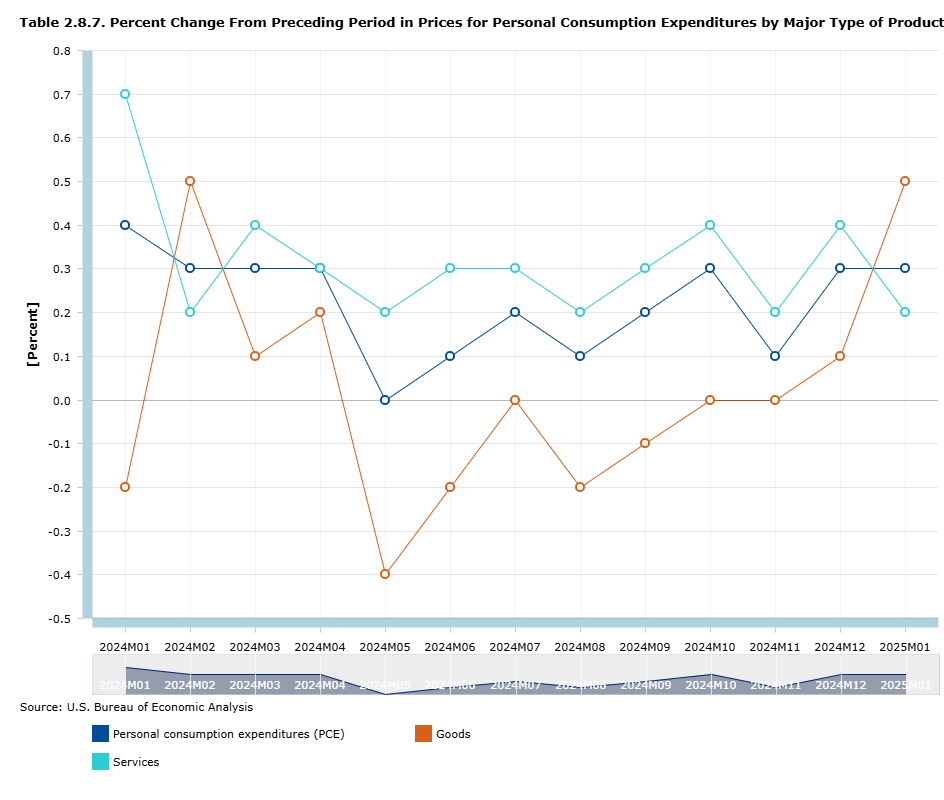

The most recent CPI data released on March 12, 2025 indicates that consumer prices have increased by 2.8% YoY in February. This potentially indicates an increase in PCE, which increased by 2.5% YoY in January, and is scheduled to be released on March 28, 2025 for the month of February.

As far as Fed’s potential response is concerned, there is a current baseline prediction of three interest rate cuts; two in this year and one in next year but the expectation of what would get you there has pretty much changed. It is still possible that we could see these ‘normalization cuts’ if the inflation is lower i.e., if tariffs come in smaller than we are currently expecting. If we assume a 10 percentage point increase in effective tariff rate and take into account the retaliatory tariffs then it would mean inflation runs closer to 3% and even if we feel that the underlying inflation trend is lower, 3% would be too high for normalization cuts. Instead the market is now trying to price the 2019 style ‘insurance cuts’.

Chair Powell indicated in the January meeting that they are not going to be in a position to make important decisions when there is so much uncertainty. So in the short term Fed would prefer not to change their stance on the policy until they have a sense of what the White House is going to do. In the long run, it really depends on the impact of tariff policies on the economy.

Work Cited

AI adoption

https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai

Future of Autonomous Vehicles

Waymo

https://waymo.com/blog/2024/06/largest-autonomous-ride-hail-territory-in-us-now-even-larger

PCE

CPI

https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category-line-chart.htm