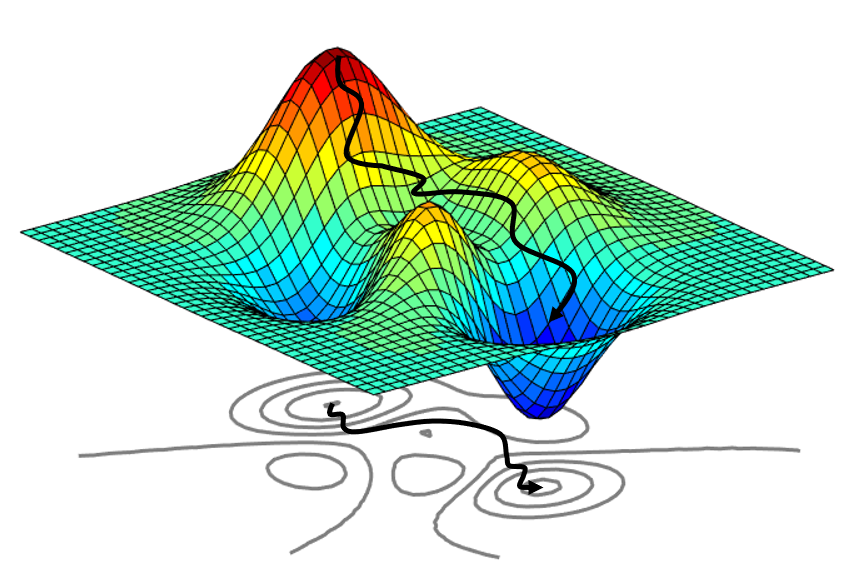

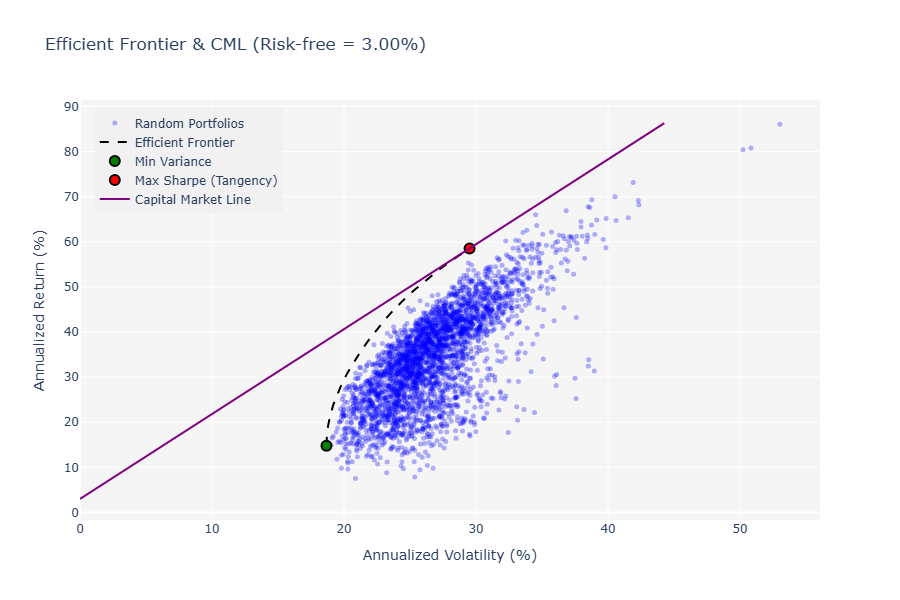

Markets today are more unpredictable than ever, with powerful shifts like AI adoption, rising interest rates, and geopolitical fragmentation reshaping how we think about investing. We’re no longer in a typical business cycle where the classic 60/40 portfolio reliably works—structural megatrends are positioned to drive long-term returns (Blackrock Global Outlook 2025). That’s where portfolio optimization and tactical asset allocation comes in: The DRG Portfolio Optimization Live Tools make this easy by showing you how different stocks work together—and which combinations may give you the best chance at growing your money safely.

Introducing DRG’s Equity Portfolio Optimizer: Smart Allocation for a Changing Market

Built for markets that no longer follow the old rules—where traditional 60/40 portfolios fall short, and investors need the ability to directly increase their exposures to megatrends defining tomorrow’s winners.

Created by Ronsard Mondesir using mean-variance optimization based on Modern Portfolio Theory.

→ Click the chart to open the tool

→ Enter tickers like AAPL, NVDA, or TSLA

→ Watch how portfolios shift along the efficient frontier and improve risk-adjusted returns.

Investment Themes Shaping the Future

Explore them with our tool by inputting their respective tickers—and see how stocks in these sectors fit into a more optimized, future-ready portfolio.

AI & Digital Infrastructure

Artificial Intelligence is not just a trend—it’s a foundational shift in how businesses operate and innovate. It’s fueling demand for semiconductors, cloud platforms, and secure data systems. Companies powering this infrastructure are positioned for long-term growth as AI adoption expands across industries.

Healthcare & Aging Populations

As demographics shift and medical innovation accelerates, healthcare is becoming a long-term growth engine. Companies focused on biotech, diagnostics, personalized medicine, and healthcare infrastructure stand to benefit from rising global demand.

Energy Transition & Physical Infrastructure

The global push toward clean energy and resilient supply chains is driving massive investment in infrastructure. Think beyond utilities—opportunities lie in renewable energy, grid modernization, transportation networks, and materials enabling sustainability.

Interested in Building Modern Portfolio Optimization Models?

Whether you’re a student, or young professional, this is your chance to learn how to build smarter, adaptable portfolios that align with real-world trends .